FUNDING AN ELITE

GROUP OF TRADERS

FUNDING AN

ELITE GROUPOF TRADERS

OF TRADERS

Telos Capital is an exclusive prop firm dedicated to developing and funding profitable traders.

Telos Capital is strictly an invite-only proprietary trading firm.

Small Call to Action Headline

Small Call to Action Headline

Trade up to $4,000,000 in funds

Choose from 2 funding options. Prove your profibitability and you will be rewarded with generous scaling plans.

Small Call to Action Headline

Small Call to Action Headline

Receive up to 100% of profits

Take home the lion's share of profits. Telos will always handsomely reward you for your hard work.

Small Call to Action Headline

Small Call to Action Headline

A very fair evaluation phase

Show case your skills with our no time pressure evaluation phases.

Small Call to Action Headline

Small Call to Action Headline

Create your own algos

Get access to our in-house software engineers to help you build your very own trading algo.

Small Call to Action Headline

Small Call to Action Headline

Exclusive Global Community

Connect with like-minded individuals around the world. Find an accountability partner to join you on this journey.

Small Call to Action Headline

Small Call to Action Headline

Member's Only Benefits

Small Call to Action Headline

Small Call to Action Headline

Trade up to $4,000,000 in funds

Choose from 2 funding options. Prove your profibitability and you will be rewarded with generous scaling plans.

Small Call to Action Headline

Small Call to Action Headline

Receive up to 100% of profits

Take home the lion's share of profits. Telos will always handsomely reward you for your hard work.

Small Call to Action Headline

Small Call to Action Headline

A very fair evaluation phase

Show case your skills with our no time pressure evaluation phases.

Small Call to Action Headline

Small Call to Action Headline

Create your own algos

Small Call to Action Headline

Small Call to Action Headline

Exclusive Global Community

Connect with like-minded individuals around the world. Find an accountability partner to join you on this journey.

Small Call to Action Headline

Small Call to Action Headline

Member's Only Benefits

Get access to additional tools & technology to help with your trading performance.

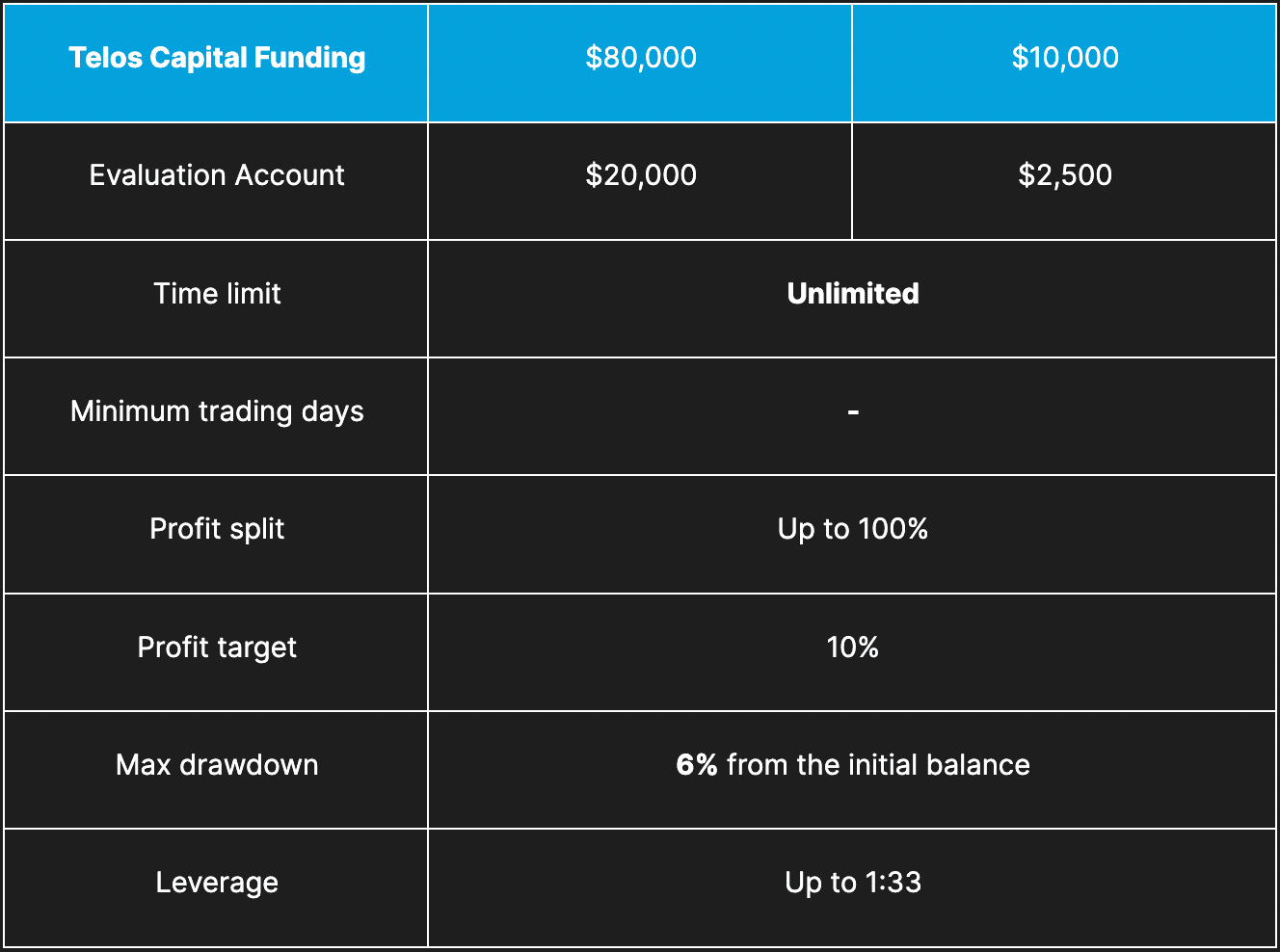

2 FUNDING OPTIONS

Telos I | 1 Step Evaluation

Large Call to Action Headline

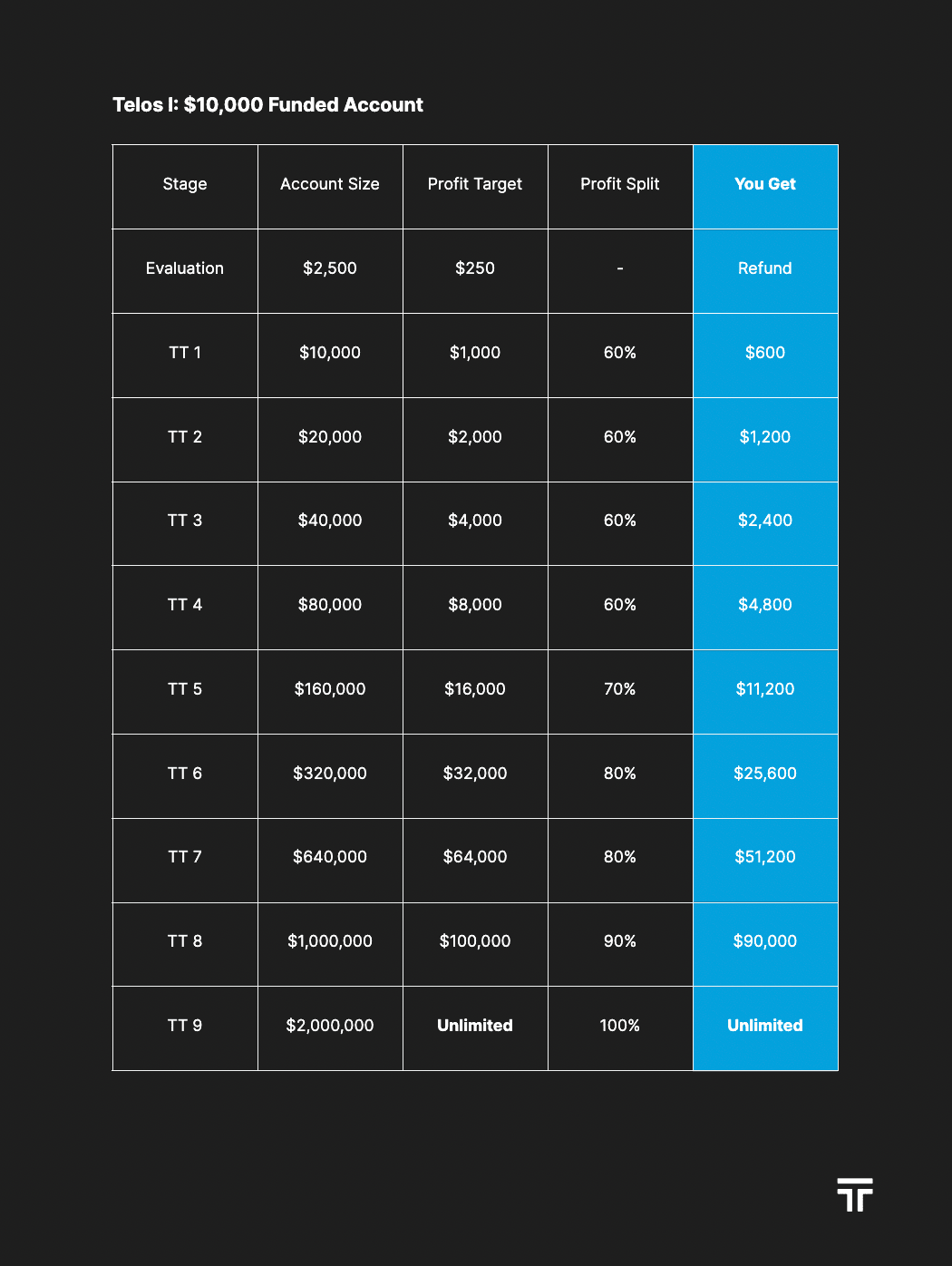

Telos I Overview

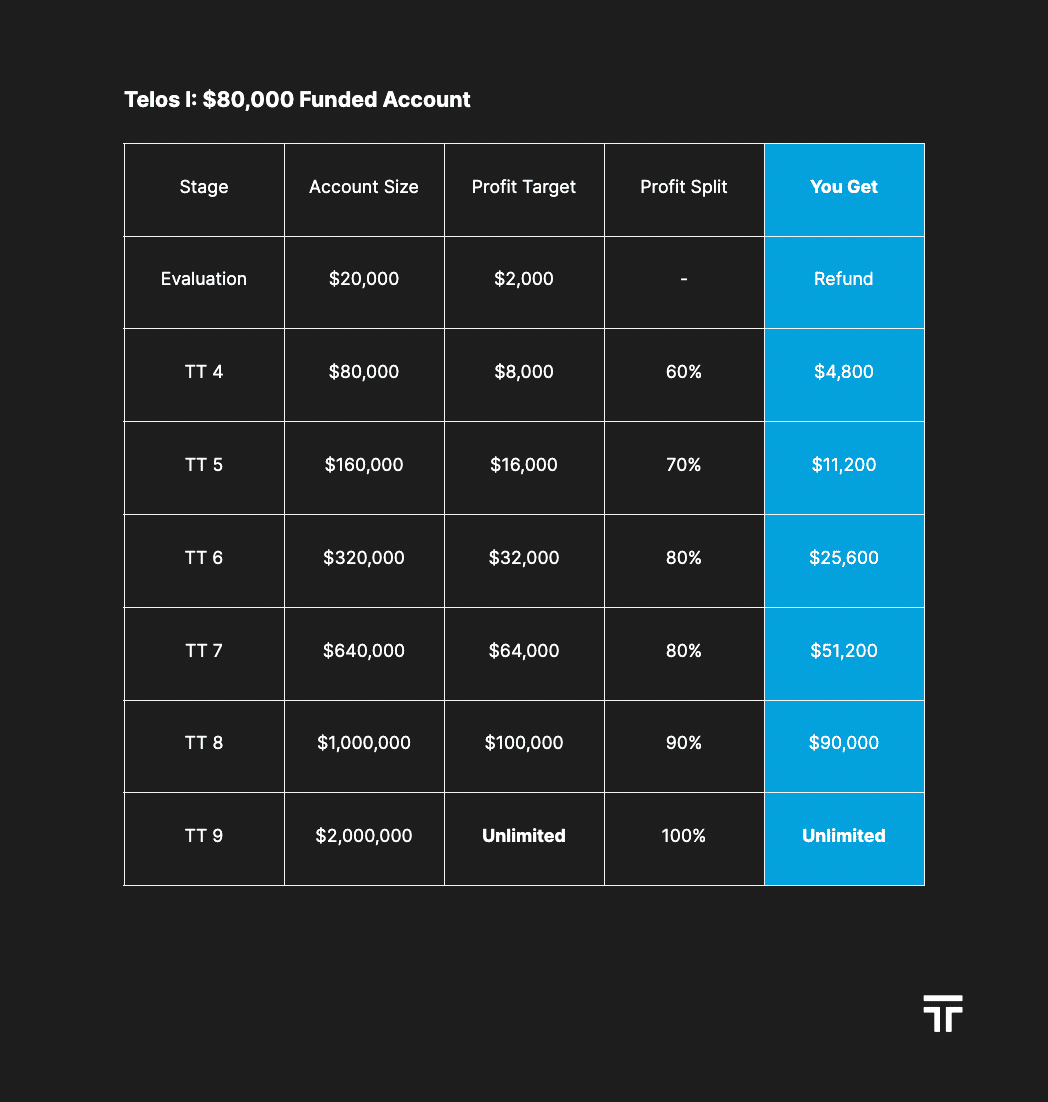

Telos I Scaling Plan

Exponential growth

Double your account every 10% profit target. Manage up to $4,000,000 in total funding through Telos Capital. Earn up to 100% profit share as you scale up.

Telos I Risk

Risk management

The max loss is a 6% drawdown from the initial balance.

The losses can never exceed 6% of the initial account balance.

Formula: Stop Out Level $ = Initial Account Balance - (6% x Initial Account Balance).

Risk management per trade

Telos Traders must have stop losses placed within 60 seconds of placing their entry.

Any trades without a stop loss will be a violation.

Telos I Payouts

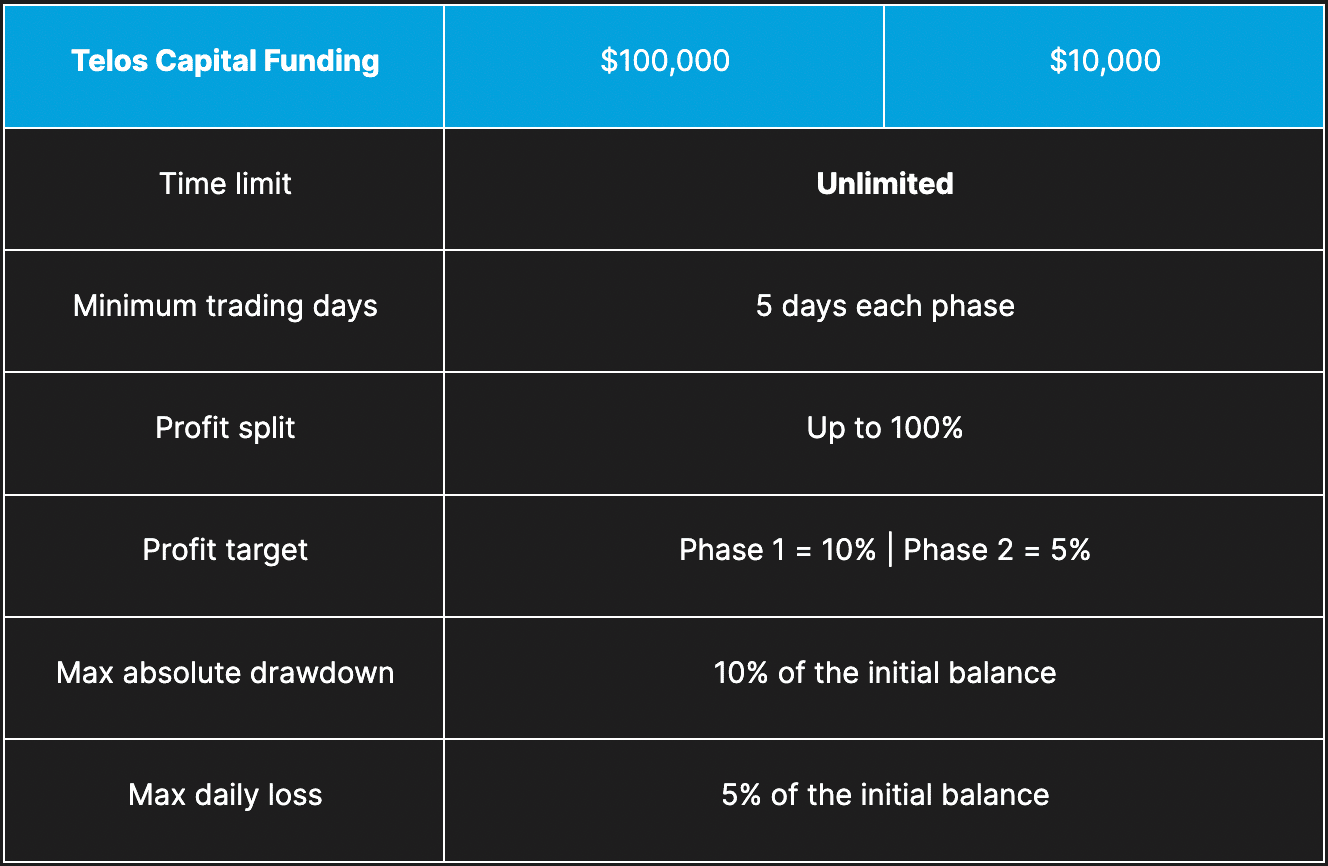

Telos II | 2 Step Evaluation

Large Call to Action Headline

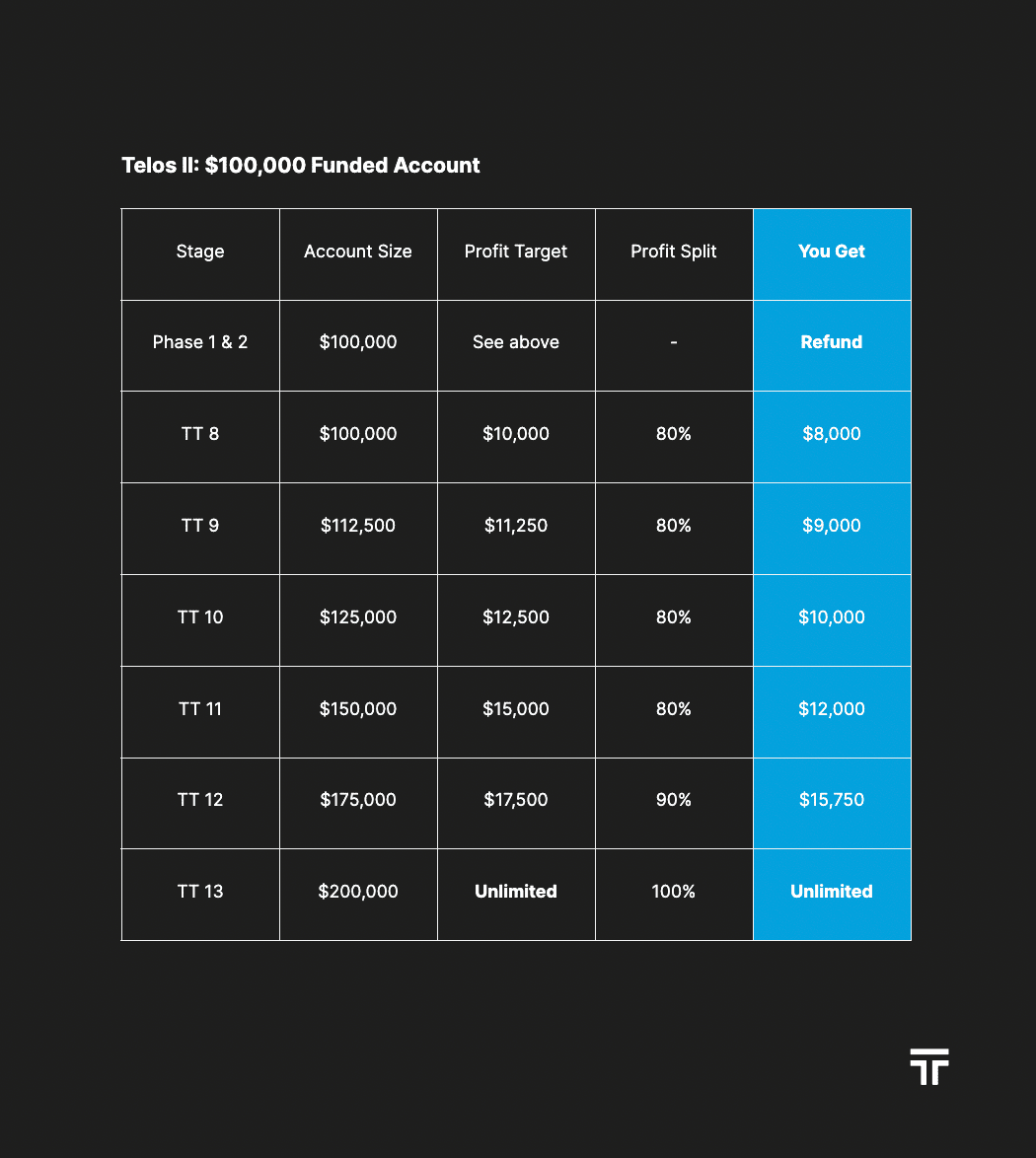

Telos II Overview

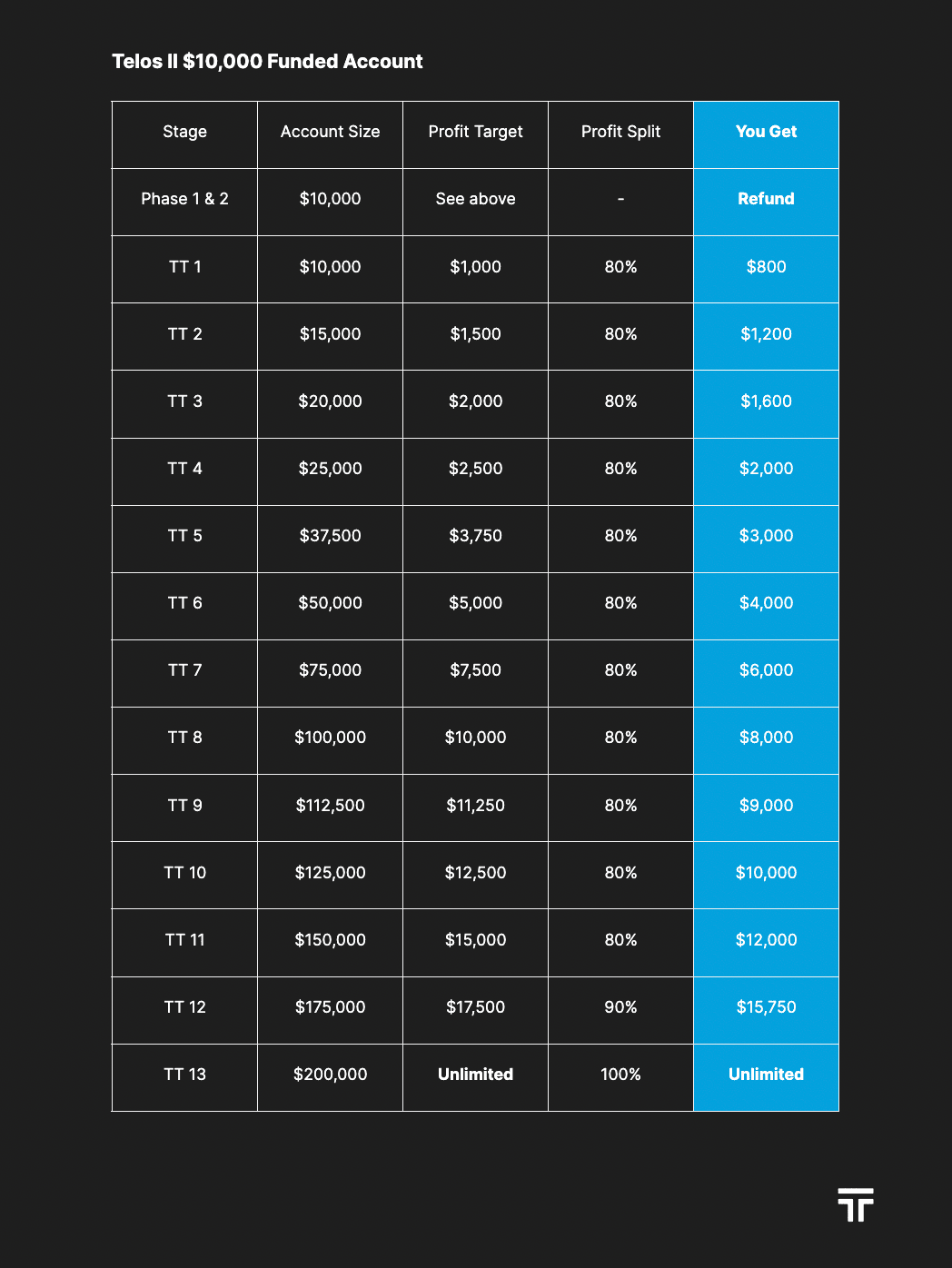

Telos II is a 2-step evaluation suitable for (but not restricted to) day traders.

Trade Forex, Indices, Commodities & Crypto.

You have the freedom to hold your trades over the weekend, overnight & trade news.

Telos II offers a refundable one-time payment.

In Phase 1, you'll be given an account to show your trading skills.

In Phase 1, you'll be given an account to show your trading skills.

In Phase 2, you'll be given a new account challenge but with half the profit target as Phase 1 to confirm your consistency and risk management skills.

Telos II Scaling Plan

Telos ca

Telos II Risk

Risk management

The max loss on the account is a 10% drawdown, which is a fixed loss from the initial balance.

The losses can never exceed 10% of the initial account balance.

Formula: Stop Out Level $ = Initial Account Balance - (10% x Initial Account Balance).

Risk management per day

On any given day, the maximum loss must not be equal to or exceed the value of 5% of the initial account balance.

Formula: Max Daily Drawdown = 5% x Initial Account Balance

And, your daily stop-out level (DSL), would be:

Formula: DSL = Start of Day Account Balance - (5% x Initial Account Balance)

Telos II Payouts

FAQ

Who can join Telos Capital?

Anybody! We welcome all traders.

How does Telos Capital make money?

We copy our profitable traders.

Telos Capital makes money from internally copying it's profitable traders onto business capital.

Can I try Telos Capital brokerage to test spreads, execution & commissions?

You sure can!

Check out our spreads, commissions, execution speeds and lot size calculations with the free demo account below.

(Make sure you right-mouse click > “show all” to view all available tickers).

Click here to download the MT5 platform.

Demo account size: $100,000

Leverage: 1:33

Platform: MT5

Login: 744099

Password: mytmyt10pb

Server: CBT Limited

What markets (and symbols) are available to trade?

What are Telos Capital's Terms & Conditions?

Here is the most up to date version: TelosCapitalTermsAndConditions.pdf